How the Consortium Blockchain Works

September 25, 2019

Corda and Real Businesses Built on Top of This Framework

August 23, 2019

We expected this move by the social media giant for a long time. Both Telegram with its TON and Facebook with a secretive project remained in the center of attention. The public and corporate worlds anticipated the big news as these tech titans would immediately challenge the status quo.

Last year in December, Facebook leaked that it was preparing to launch its own cryptocurrency in WhatsApp. Back then, Bloomberg reported that a new Facebook coin will be stable and focus on the Indian market. Today, we are seeing the official announcements, and this article will distinguish reality from manipulation.

Libra is a generic crypto asset protocol developed by Facebook and developed by its daughter company Calibra. The latter positions Libra as a “global cryptocurrency built on the foundation of a blockchain, the Libra Blockchain,” whereas in reality a cryptocurrency is censorship resistant, decentralized among all stakeholders, and assumes their anonymity.

Initially, Libra will be a stablecoin pegged to a basket of currencies, the Libra Reserve, resembling the IMF’s Special Drawing Right (SDR) system. Thus, it is unlikely to become a speculative asset or influence the cryptocurrency market capitalization. Calibra is also a name of the wallet that will be built-in in WhatsApp and Messenger. Facebook won’t fully control Calibra but instead have a single vote among other 28 organizations within Libra Association, a non-profit based in Switzerland that has several layers of governance.

The project aims at building trust in its intrinsic value but will have more applications as we learn later. Besides, Facebook claims that the “Libra protocol does not link accounts to a real-world identity” but adds “without customer consent.” One user will be able to create several accounts by generating multiple key-pairs, and they will not have a common link.

At first glance, Calibra resembles a traditional financial company, but its close integration with a huge Facebook user base can give it a significant advantage over any competitor. Its immediate goal is to develop and launch a standalone application for iOS and Android that will also work for those users who do not have Facebook accounts. The main functions include safe storage and the ability to transfer tokens to anyone on the planet for a fee, which is times lower than the existing tariffs of international money transfers.

Calibra is currently being built, but you can sign up here for early access. To register, Calibra will require your government-issued ID “to comply with laws and prevent fraud.” If earlier this social network knew everything about you, now it will know even more. Of course, a digital wallet Calibra promises to be solid-proof against fraud and is committed to never transfer your financial data, transaction history or help social network’s advertising departments, but Facebook remains a poor reputation to believe that.

“The Libra protocol allows a set of replicas—referred to as validators—from different authorities to jointly maintain a database of programmable resources.”

Reputable Bitcoin developer Jameson Lopp believes this translates into “the system [that] will be controlled by a set of authorities in a top-down fashion. However, note that it says the database is for ‘programmable resources’ rather than just digital currency.” Thus, Lopp denotes that the linguistics behind the word “resources” implies a broader usage of distributed ledger technology and smart contracts in the future.

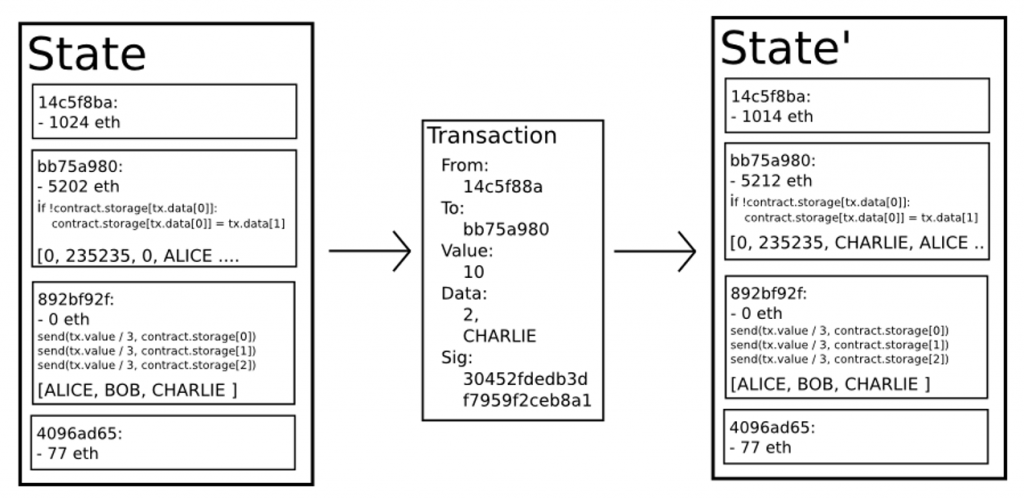

The programming language of Libra is called Move and was developed explicitly for Facebook’s coin. Move defines the logic behind Libra blockchain. From the description, we also learned that Libra is a “type of resources,” which could imply an introduction of other types.

Consensus: Practical Byzantine Fault Tolerance (PBFT)

Speed: High (1000 t/s)

DLT setup: Private, permissioned blockchain (with an option to transit to permissionless)

Finality: Immediate (10-sec intervals)

Similar to: Hyperledger, Chain

Additionally, the Libra Blockchain leverages an account-based data model to update the ledger state. So from a data structure perspective, the project resembles Ethereum or Ripple rather than Bitcoin. While a UTXO model ensures better privacy and a more solid transaction history thanks to the simplicity of the output-based history, it might be harder to interact with complex smart contracts. Therefore, the account model of Libra fits Facebook well to allow further developments atop the new financial platform.

The structure of the system relies on timestamps of the ledger state instead of the blocks of transactions. This “single versioned database” is something we could refer to as a consortium blockchain or a federated blockchain. The system is also likely to leverage a resource cost system similar to the one of Ethereum to eliminate resource exhaustion attacks.

Although Libra’s whitepaper claims pseudonymity of transactions, there is a doubt about that: it is yet unknown if one can purchase Libra coins freely on the market without going through the AML/KYC procedure. If not, every token holder could be identified.

The team behind Libra claims to deliver the service at “low fees during normal operation, when sufficient capacity is available.” However, we don’t know what this means and what is considered to be “low” or “normal.”

“Can’t wait for a cryptocurrency with the ethics of Uber, the censorship resistance of Paypal, and the decentralization of Visa, all tied together with the proven privacy of Facebook.” — Sarah Jamie Lewis on Twitter.

Minimum node requirements:

Calibra team wrote implementation in Rust language which signals a favorable beginning for security and stable performance. Moreover, the Libra Association is hoping to have the Libra Blockchain and all the features associated with it to be fully inspected and secured by the white hacker community before the mainnet launch in 2020.

Dapps, smart contracts, and related API are yet to be announced.

There is already an accusation of plagiarism. The Verge referred to the striking similarity of the Libra’s logo to the one of Current. Although a complete accident is possible (both tildes and circles are quite common shapes), the two companies offer financial services, and there could be confusion later on.

If that was not enough, some believe the whole idea is foolish. However, the product serves the purpose: Libra will simplify payments for millions of users who already discuss their cross-border payments on Messenger. This will ease the process and reduce costs of maintaining such an infrastructure, causing lower fees for both users and businesses. Eventually, Facebook will emerge into an online bank.

Washington Post expects the coming months to be the legal battlefield regarding the potential “effect on poverty, law enforcement, currency stability and even national sovereignty.” However, journalists stay skeptical that the unbanked Libra strives to help will play any role in shaping the project, taken the nature of public debate in the United States and other countries.

On July 16th, a Senate hearing on “privacy considerations” by Facebook’s novel project will take place. Although no witnesses have been announced for the hearing, David Marcus who is leading Calibra will likely testify for Facebook.

Facebook’s coin Libra is neither a cryptocurrency nor a blockchain. Nevertheless, the initial tech analysis indicates solid account-based structure where predetermined validators will reach consensus with the help of PBFT protocol. Data itself will sit on a shared but permissioned ledger.

While crypto community overall is quite skeptical about Facebook’s foray into the Bitcoin world, blockchain developers are more optimistic: this move by the social network can set off a chain reaction for even deeper blockchain adoption and DLT integration with global business verticals and institutions.