Corda and Real Businesses Built on Top of This Framework

August 23, 2019

Earlier, we have reviewed both public and private blockchains. Today, we invite you to deep dive into the premises of a consortium blockchain.

A consortium blockchain is a relatively new way of using Satoshi’s blockchain technology for enterprises. If public blockchain is accessible for everyone and the private one usually services one enterprise, consortium blockchain is a hybrid of the previous two versions but closer to the private type of a distributed ledger.

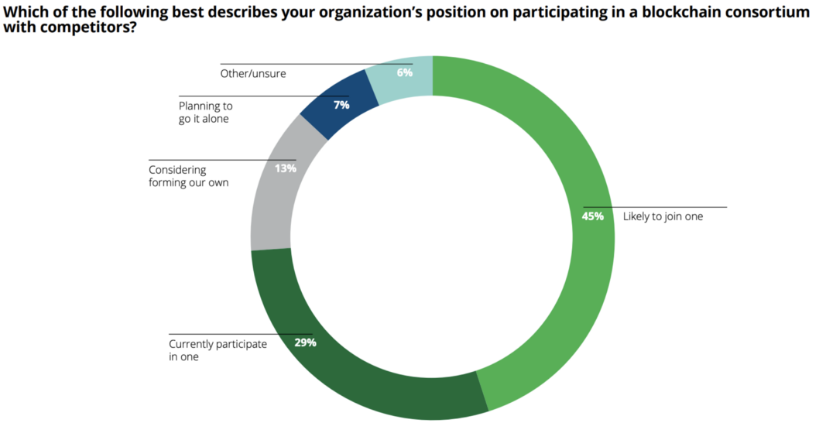

The main idea behind it is to meet the challenges of a particular industry by scaling the effect of cooperation. This creates an advantageous network, which includes not only business allies but competitors too. This is what the research of Deloitte proves, showing that 74% of organizations are participating in a blockchain consortium with competitors or would like to join one.

Pic.1. Organization’s position concerning participating in a blockchain consortium with competitors. Source: ConsenSys

With consortia, newcomers can join the formed structure and shared data instead of building it from scratch. At the same time, through solving common problems together, companies reduce development costs and time expenses. Finally, coordination of actions and expertise exchange helps to avoid duplication, so that different subjects wouldn’t do the same work, but share responsibilities.

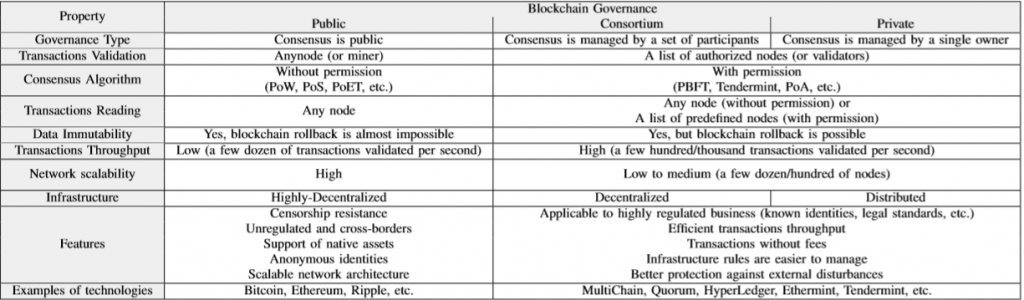

The best way to understand the system is to compare it to other well-known, established platforms, so let’s look at the picture below.

Pic.2. Comparison of blockchain network types. Source: ResearchGate

As we can see, the difference between the consortium and private approaches can be hard to explain at first sight. So far there has been little emphasis on their distinction but the key differentiators are the number of included organizations and a consensus method.

Private blockchain “can be more accurately described as a traditional centralized system with a degree of cryptographic auditability attached,” argues Buterin, a co-founder of Ethereum.

The consortium blockchain is a hybrid between the ‘low-trust’ offered by public blockchains and the ‘single highly-trusted entity’ model of private blockchains.

Its characteristics are the following:

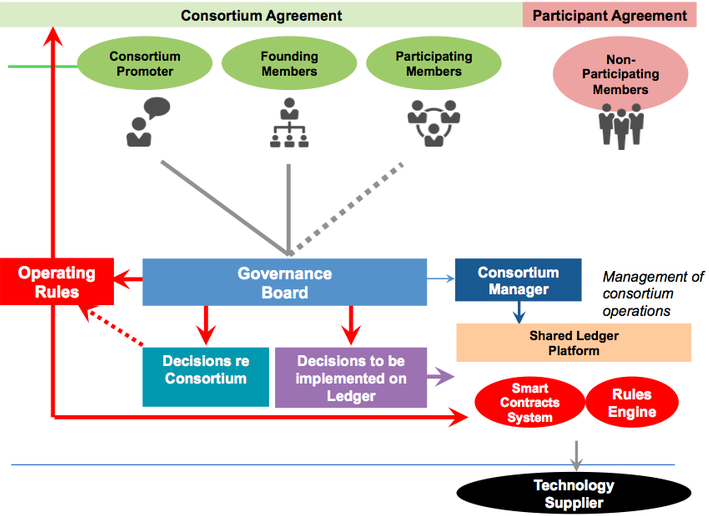

The governance roles and operating rules emergence in consortium blockchain are exhibited in the picture below.

Pic.3. Consortium Blockchain Strategy. Source: Medium

Standard Proof-of-Work and Proof-of-Stake consensus algorithms are designed for trustless environments and fit public platforms well. However, they come with a tradeoff of low speed, probabilistic finality, and 51%-type of attacks.

In consortium blockchain, there are fewer participants who are also known. Since it often comes as a voting-based system, it ensures low latency and superb speed. Every node can write or read transactions, but no one can add a block on their own. To do that, every node (or supermajority) must confirm that block. If this rule is unsatisfied, the block can’t be added.

Now, as we’ve covered the principles of a consortium blockchain, what are the benefits?

Nevertheless, an attempt to develop and optimize a system for a narrow use may result in certain gaps and risks. Next, we are going to evaluate the possible downsides of the consortium blockchain.

Now, it becomes clear that a consortium platform is a worthy innovation that drives the adoption of blockchain. There are specific industries where consortium approach fits well.

Finance and Banking. This one relates to issuance and trading of assets. Another common application is KYC. A group of banks creates a shared database, where all necessary information about creditors is commonly collected and stored. Once a bank needs the information to identify and assess someone, the bank takes it from the distributed ledger.

Logistics. Consortium is an optimal solution for creating a network for all supply chain participants. It is useful for product tracking in order to identify its provenance and the way of supplying.

Healthcare and Insurance. Every time a person visits a hospital, he/she claims for insurance payment. In order to speed up this process, hospitals and insurance companies may join the consortium to exchange information and money seamlessly and paperlessly.

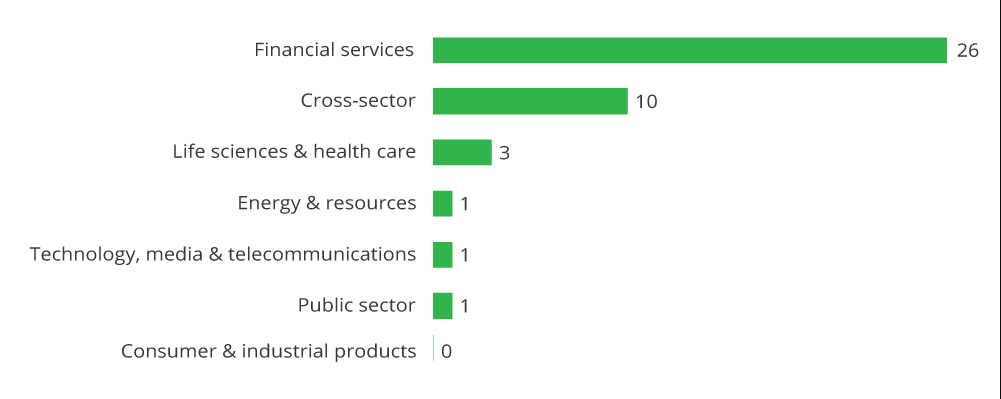

This analysis by Deloitte gives an understanding of the blockchain consortia distribution by industries (2017).

Pic.4. Blockchain consortia distribution by industry. Source: Deloitte analysis.

It is evident that financial and cross-sector implementations are the most appropriate for the blockchain consortium. At the same time, new industries appear.

There are some typical platforms that may be used for creating own consortium: Ripple, Hyperledger, Corda, Quorum, MultiChain, Ethermint, Tendermint and others. These are open-source solutions that let any enterprise or a group of enterprises create their own consortium blockchain.

The first implementation of consortium on Ripple was conducted in the US and Mexico through xRapid instrument. Ripple is the open-source platform which is designed for international money transfers. The platform allows to exchange any currency using Ripple tokens, XRP, that makes transfers between international financial institutions much faster and cheaper. The consortium consists of three entities – Mercury FX, Cuallix and Catalyst Corporate Federal Credit Union. This consortium is designed for money transfers from the US to Mexico.

The mechanism is the following: USD is converted to XRP on native asset exchange. Then, XRP is transferred to Mexico in a few seconds instead of 3-5 days through SWIFT. Finally, XRP is converted to MXN in Mexico. This consortium also includes three asset exchanges: BITTREX, BITS and COIN.PH. In fact, the system doesn’t use blockchain itself, but it’s own technology – Ripple protocol consensus algorithm (RPCA). Its type of consensus doesn’t require mining and is managed by a network of independent verification servers that comprise a pool, where the transaction will be validated in case supermajority of nodes reaches an agreement.

The Voltron consortium was launched by R3 and CryptoBLK in 2018. It involves twelve banks: HSBC, BNP Paribas, BBVA, SEB, Natwest, Scotiabank, Mizuho, ING, Intesa Sanpaolo, Bangkok Bank, U.S Bank, and CTBC bank. The purpose of the consortium is to digitize documentation and decentralize sharing through blockchain. The transaction takes less than 24 hours instead of several days as it was before.

It is another project based on R3’s Corda. The platform was created in cooperation with TradeIX and now consists of ten financial organizations: Natixis, Standard Chartered, SMBC, Bangkok Bank, OP Financial, DNB, ING, Commerzbank, BNP Paribas, and NatWest. The aim of the consortium is to simplify trade flow by moving trading relationships and supply chain issues to blockchain platform. It operates with money, assets, credit, goods and appropriate data exchange, and makes it seamless and secure.

This project was created by IBM in 2016 and consists of only five banks: UBS, Erste Group, Commerzbank, CaixaBank, and Bank of Montreal. This consortium is a multi-party network that enables trading across the world. Trade transactions and data exchange are completing in a digital and automated way using smart contracts and blockchain ledger. First live pilot transactions were successfully conducted between different countries and trading parties.

It is a trading platform created by IBM on Hyperledger Fabric. Eight banks are taking part: Santander, Nordea, UniCredit, Natixis, KBC, HSBC, Deutsche Bank, and Rabobank. The project provides clients with fully automated order-to-payment process on smart contracts and aims to eliminate risks of international payments and transactions. Through online interface it is possible to create trade orders, select banking products and payment conditions, request bank payment undertaking, request invoice financing, and even track the entire trade journey on the dashboard.

This consortium was created by Primechain Technologies in 2017. It consists of 37 members and partners. The project is a bank community that proposed eight live projects: Global marketplace for Invoice discounting, Charge Registry, Corporate KYC, Document authentication & Verification using Electronic signatures, Issuance storage and distribution of Trade Documents, Transparent rating & review, Global marketplace for Government Securities, and Global marketplace for private debt Instruments.

This consortium was launched by CargoSmart, a provider of hardware and software solutions. Currently, it consists of nine ocean carriers and terminal operators: COSCO Shipping Lines, CMA CGM, Evergreen Marine, OOCL, Yang Ming, DP World, Hutchison Ports, PSA International, and Shanghai International Port. This is a supply chain project that creates a single shared digital database instead of multiple fragmented businesses across the chain. Thus, it operates as a network of supply chain members who exchange all data quickly, easily, and efficiently through a distributed ledger.

The consortium blockchain seems to be the right balance between private and public setups resulting in stronger privacy and sufficient level of decentralization. Cooperation with partners on blockchain platform makes it possible to solve common problems together and considerably reduce operational costs and time expenses. The main benefits of consortia are their greater speed and scalability of transactions as well as reserved privacy and automation.

If you want to derive the most economic benefits for your business while cooperating with other organizations, the consortium blockchain can optimize and improve communications and operational flow between the parties. To create it, any entity can use an open-source platform suitable for the industry and goals. The use cases identified the best industries for this: finance and banking, supply chain and logistics, insurance, and healthcare. Although one can set his own standards and conditions, it is always a good idea to consult with professional blockchain developers.