How the Consortium Blockchain Works

September 25, 2019

Corda is a distributed ledger software for storing, managing and synchronizing contracts and agreements between different financial firms as well as individuals in a secure, consistent, and auditable manner. It was launched in 2016 by R3 together with more than 200 partners. Notably, most of the companies that support Corda are banks and financial companies. Among them are HSBC, U.S. Bank, Barclays and other credible institutions. Like other open-source projects, thousands of developers around the world contribute to the project by adding new features to the main solution.

The main idea of Corda is to move from authoritative systems-of-record maintained within firms to global authoritative systems-of-record shared between all economic players. Such a system enables businesses to commit transactions directly and in strict privacy using smart contracts while notably reducing costs and streamlining business operations.

In fact, Corda is not the exact type of standard blockchain. According to the founders, it has absorbed the best features from Bitcoin, Ethereum and other networks in order to create the ideal platform for a highly specialized purpose: to manage financial agreements between regulated financial institutions (this was stated by R3 CTO Richard G Brown). So, let’s get a more clear understanding of the particular qualities of Corda by comparing it with other popular open-source projects – Hyperledger and Ethereum.

|

Characteristics |

Ethereum |

Hyperledger Fabric |

R3 Corda |

|

Smart contact language |

Solidity |

Go, Java, JavaScript |

Kotlin Java Scala |

|

Governance |

Distributed among all participants |

Linux Foundation and organization in the Chain |

R3 and organizations involved |

|

Consensus Algorithm |

PoW, PoA (Aura), PoS (Casper) |

PBFT, CFT (Kafka, Raft) |

Notaries (Notary nodes can run several consensus algorithms) |

|

Permissions |

Yes (limited) |

Yes |

Yes |

|

Anonymity |

Low |

Low, can be changed or configured |

Low, can be changed or configured |

|

Currency |

Yes (master + token contracts) |

None, can be made using chaincode |

Configurable cash entity |

Also, you can go deeper into our research — all Blockchains Comparison Table.

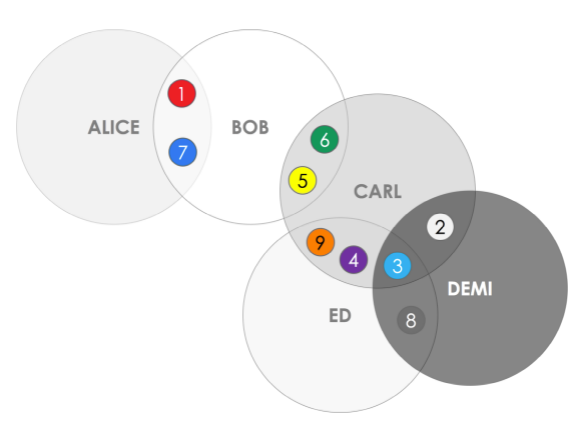

In order to best serve the financial operations, especially international, Corda really concerns about privacy. Transactions are not broadcasting to all the nodes in the system, like standard blockchains do (for example, Bitcoin). They are admissible only to those interested parties, who are directly related to it. In practice, this means that most nodes may never encounter a flow of transactions and they will never be involved in their processing. So there is no single central store of data. You can see that at the picture below, Alice and Bob know only about transactions 1 and 7, while Carl, Ed and Demi have no idea about it.

Source: https://docs.corda.net/key-concepts-ledger.html

Another distinguishing feature that comes out from the previous one is a two-types consensus. The first one appears between parties of a transaction — Validity consensus. In this case, parties can see all private information. The second one is the Uniqueness consensus. This consensus is implemented by a notary service that plays the same role as miners in Bitcoin blockchain. Its task is to avoid double-spending and eliminate the possibility of duplicating inputs to a proposed transaction if it’s already involved in the other transaction.

Interestingly, Corda is not an anonymous network. Corda implements its core identity framework through the use of X.509 certificates. This enables Corda to associate a unique “human-readable” entity name (i.e., a legal name) with a public key and network address (IP address). Corda strictly requires uniqueness in this mapping.

Corda uses existing technologies and languages to make the development process easy. Everyone can use these tools to start their CorDapp development. See picture 2.

Source: https://www.corda.net/get-started/

Corda proposes a number of fields where their solution can be implemented. Among the major case,s Corda sees blockchain implementation in capital markets, digital assets, and digital identity. Corda helps to launch instant settlements and payment obligations between participants in a B2B network. It also has the possibility to develop digital assets for institutional use. Plus, Leverage Corda Settler allows settlement via any payment rail of any outstanding payment obligations arising on Corda Network. Thanks to these and other features, Corda presents solutions that find their application in the financial field.

According to the organization, Corda is aimed to assist the other sectors such as

Keeping that in mind, let’s take a look at some examples of Corda’s implementation in real companies.

CryptoBLK is a Hong-Kong fintech company that provides companies with DLT-based financial solutions. In 2018 CryptoBLK in cooperation with R3 and HSBC created the Corda-based letter of credit platform called Voltron. Using the platform, HSBC and ING executed the world’s first letter of a credit transaction on a blockchain platform for Cargill. The transaction took less than 24 hours. Now, CryptoBLK is working with R3 to engage more banks to the platform to spread this solution to the world.

GuildOne is an Alberta-based company that supplies database solutions across Western Canadian oil and gas industry. It wanted to reduce complexities in royalty contract transactions using cloud and DLT technologies.

So R3 and an AWS Advanced Technology Partner designed the platform based on Corda blockchain. As the COO of GuildOne Mike Gee shared, the proof of concept stage took three weeks, and as the result of all efforts, a transaction with all the parties took around 30 seconds.

“We conducted the transaction from the NAL Resources boardroom. ATB Financial, the bank represented on the ledger, had already done the banking transaction, meaning they’d put cash on-deposit and issued their on-ledger position, so they had money to spend on the ledger.”

Then, they negotiated the contract and achieved consensus within a few minutes while calculating the production volume for the previous month and computing the royalty. As GuildOne settled the deal, it resulted in an EFT to the payee’s bank account. A confirmation arrived when the money was received. Thus, all the participants became confident in the success of the transaction and a relevant input onto the ledger.

It is a complicated procedure to synchronize the banks at each end of a transaction. Usually, the task is time-consuming and labor-intensive due to the lack of standardization and piecemeal communication methods. That’s why in 2018 a group of 17 Italian banks and R3 has collaborated to run a successful proof-of-concept for a blockchain-enabled interbank reconciliation system based on R3’s Corda Enterprise.

In this case, Corda team helped to solve the interbank reconciliation problem in Italy. The trial carried out successfully, and it was processed a total of 1.9 million transactions. The group is now working towards testing the solution in daily operations across the entire Italian banking sector (around 200 banks).

In 2018 the digital business consulting and technology services provider, Synechron, in cooperation with R3 and their Corda team built a blockchain-based self-sovereign corporate KYC solution. It was named LEIA II. The main idea was to accelerate the KYC processes. Often, it requires each customer to exchange information with a financial institution that they deal with. In fact, this procedure repeats with the same client for every institution. Banks also need to check their clients’ information on their own.

So the LEIA II was created to do it once by any of institution, and then get access to needed information from decentralized storage. In mid-2018, the Corda-based LEIA II KYC solution was successfully conducted. It has run for four days and included over 300 KYC transactions in 19 countries across eight different time zones.

The world-leading financial technology firm Finastra has collaborated with R3 and a group of global banks to create a blockchain platform for the syndicated lending community — Fusion LenderComm. It was designed to bring unprecedented transparency and efficiency—and ultimately higher liquidity to the syndicated loan market.

The company’s loan servicing platform, Fusion Loan IQ, has become the market standard used by the world’s biggest agent banks. It exposes Loan IQ to the entire market in a controlled and secure way. France-based banking institutions BNP Paribas, Natixis, and Societe Generale have officially joined Finastra’s syndicated lending platform Fusion LenderComm in 2017 and United Kingdom-based bank NatWest in 2018.

Launched in 2017, the Marco Polo Network provides an open enterprise software platform for trade and working capital finance to banks and corporates and a distributed, blockchain-powered solution that allows for the seamless and secure exchange of data and assets between participants.

The Marco Polo network implements R3’s Corda enterprise blockchain technology together with a distributed trade finance platform from TradeIX. It consists of major international banks such as BNP Paribas, ING and Sumitomo Mitsui Banking Corporation as members. Other prominent bank members include Standard Chartered Bank and NatWest.

Austria’s Raiffeisen Bank International (RBI) has announced it will pilot R3’s Marco Polo blockchain network. In 2019 a major Brazilian bank, Banco Bradesco, has become the latest institution to join R3’s Marco Polo blockchain network. Marco Polo successfully conducted its first live trade finance operations in March 2019 in operation involving two German firms and major local bank Commerzbank.

On February 1, 2019, the news hit that the global interbank network SWIFT would test a new payment standard. Based on the blockchain platform R3 Corda, they developed a proof-of-concept for monitoring payment channels and API support.

Corda was built with the explicit purpose of recording and enforcing business agreements between trading partners. Although the creators of the platform tell that Corda can be implemented in various industries, today we can see that mostly all completed projects serve the financial sector.

The platform is well adapted to advance the way financial institutions use different instruments. It can be used for known identities to inject trust into the system or validity consensus for greater privacy.

Finally, it’s an open-source platform, so everyone can start developing on Corda Application or “CorDapp.” A complete list of needed documents to start is available on their website.