How the Consortium Blockchain Works

September 25, 2019

Corda and Real Businesses Built on Top of This Framework

August 23, 2019

Several factors contribute to the complexity of financial transactions in company operations and across third-party providers. These include:

These are the most influential factors contributing to financial system complexity. And while they feature less prominently within organizations, the risks they pose increase exponentially when operations involve more than two parties. A classic example of this is a supply chain, where simple delivery could involve more than 3 or 4 parties. Together with financial intermediaries, the full transaction could involve up to 10 parties in just one agreement. If you look at the entire value chain, including the product or service being purchased, information communicated between the parties, and financial flows, there could be hundreds of involved parties for a large enterprise and dozens for a medium-sized one.

Although new IT innovations have helped address some of the concerns listed above, finance teams and financial service providers remain obligated to adhere to strict privacy requirements. Finance teams bear the risk of financial losses, and of outside parties seeking partial control over internal operations and centralized IT systems. This is one reason for the creation of formal standards for transactions between financial organizations such as SEPA, Swift, Visa or MasterCard.

Another solution is to have a distributed system over which all parties have partial control, and maintain significant, if not full, respect for privacy. The solution that most effectively meets these criteria is blockchain technology. In spite of all the hype that it will destroy financial institutions, blockchain is already being utilized by large enterprises as an element of financial services organizations.

It is important to note that public blockchains are rarely used by established companies and are not typically related to investment activities. As a result, there is limited analysis available surrounding blockchain use cases.

![]()

One of the most noteworthy use cases for blockchain was presented by Microsoft at the 2019 Sibos Conference in London. Standby letters of credit are one of the major pain points for banks, because they require the involvement of 2 banks that trust each other to assure payments between 2 entities that don’t trust each other. According to a business case conducted by PwC for Microsoft and Bank of America, this process typically demands the involvement of up to 20 people, and can take up to 14 working days.

Microsoft Azure’s Blockchain-as-a-Service solution is a deployment of a private Ethereum consortium network. By using it, Microsoft creates a smart contract initiated by its counterparty that includes a commitment to payment by Bank of America. This process requires four steps and takes only a matter of hours. The transfer of funds is presented as a commitment assured by the existence of tokens under a smart contract. The actual transfer appears only when the smart contract is executed.

The contractual negotiation process between BBVA and Indra, which resulted in a €75 million loan transaction, is another example of successful blockchain use. The current process of contracting corporate loans is long and complex, requiring a series of time-intensive reviews and negotiations between the bank and the client. This pilot addressed and improved upon the complete process, from negotiation up to the signing of the loan.

The innovation of this endeavor lay not only in the product for which it was developed (corporate loans), but also in the different blockchain platforms it used. Specifically, the negotiation process and fulfilment of conditions between BBVA and Indra was developed through an internal solution built on private blockchain technology (Hyperledger).

Once the contract was agreed upon, Ethereum’s public blockchain Testnet was used to register the transaction’s hash or unique identifier. This is how blockchain guarantees the “immutability” of the contract, as any amendment to the original document would generate a completely different hash.

![]()

Intesa Sanpaolo relies heavily on emerging technology adoption, including blockchain, for its everyday operations. One innovative technology it implements is a simple indexation of its records with the protection of Bitcoin blockchain, using OpenTimestamps protocol. With timestamping, relevant data is hashed to produce a short unique identifier – a digest – equivalent to its digital fingerprint. This fingerprint is recorded on the blockchain: the blockchain immutability provides robust non-refutable timestamping that will always prove beyond any doubt the existence of that data, in that specific status at that precise moment in time.

Another related project coordinated by Intesa Sanpaolo, which featured a total of 16 other financial institutions, involved interbank reconciliation in a closed ecosystem known as a consortium chain. For this initiative, Intesa Sanpaolo used Corda, a custom Ethereum blockchain. The bank uploaded two months of real data, detailing a total of 1.9 million movements, to a 17-node infrastructure that corresponded with each of the 17 banks participating in the project. After a 10-month trial, it became clear that using Corda made the interbank reconciliation process faster, more efficient, and more transparent. These positive results are attributed to Corda’s ability to help banks quickly pinpoint mismatches in interbank transactions by sharing data securely, as well as performing tests and reconciliations directly within the application, and use standardized processes and communications for correcting issues. In addition , the system’s smart contract technology provided the participating banks with automated feedback on their transactions, further simplifying and accelerating the reconciliation process.

ING Group is one of the international banks involved in the finance venture komgo SA in partnership with ConsenSys. It starts with two products. The first product standardizes and facilitates KYC process without using a central database—instead, documents are exchanged over the blockchain on a need-to-know basis. The second product takes the form of digital letters of credit, and allows commodity houses or other platforms to submit digital trade data and documents to the komgo SA customer bank of their choice.

Due to a strong overlap of shareholders between komgo SA and VAKT, which was incorporated into the venture in 2017 to develop a blockchain based post-trade processing platform for commodities, the two companies explore synergies between both platforms. ING Group is also involved in the development of “bulletproofs,” which are zero-knowledge cryptography verification methods that enable banks to pass KYC without needing to exchange documents with clients.

Insurance company AXAcreated fizzy platform that able automatically execute insurance payments for delayed flights. If a plane is late for more than allowed time according to the policy, fizzy smart contract will reimburse dedicated payments immediately.

The platform is built on Ethereum blockchain and when clients buy flight delay insurance it is recorded and treated as tamperproof. Payments executed by smart contract that use oraclize function to receive flight data, time of arrival and departure, from global air traffic databases. When oracle (external trusted database) provide information about the delay of more than two hours, compensation transaction is triggered automatically. AXA platform is an example how company can delegate the compensation decision to an independent network.

BNP Paribas and “Big Four” accounting firm EY in October 2017 completed a trial of private blockchain network for internal treasury operations in order to reduce back office costs. BNP group apply private blockchain in its ALM Treasury department that resulted in successful trial of technology. Major takeaways declared by companies are:

BNP Paribas also known for a series of technology trials and pilots, including Cash without Borders launched by the bank’s Transaction Banking business.

MoneyGram is one of the world’s largest money transfer companies, piloting XRP in their payment flows. MoneyGram uses XRP, the native digital asset of the XRP (Ripple) Ledger, in payment flows through xRapid, Ripple’s solution for on-demand liquidity.

In traditional business model of MoneyGram it is use pre-funded accounts in different countries to source cross-border payments liquidity. To refill accounts for liquidity, company needs to leverage deposited funds to assure transaction execution on time. It means that when one party make a payment that is requiring conversion, to assure ability to withdraw funds by other party, company should centrally find party that deposit appropriate currency on account.

On the other side, Ripple is an already a network of parties that want to exchange XRP on certain currency and visa versa. Its consensus built on idea to link those parties in sequence that is allows to convert one currency into another.

Factoring is a widely used practice to assure company cash flow and liquidity. But it comes with several expensive cons:

At first glance, this seems like a perfect area to incorporate blockchain, in order to address the lack of trusts, consolidated business, and fraud due to lack of transparency. However, factoring is an area of financial services that demands strict anonymity surrounding the parties involved in the arrangement. A blockchain-based solution could mitigate the limitations of the factoring market, but it requires the development of infrastructure, including:

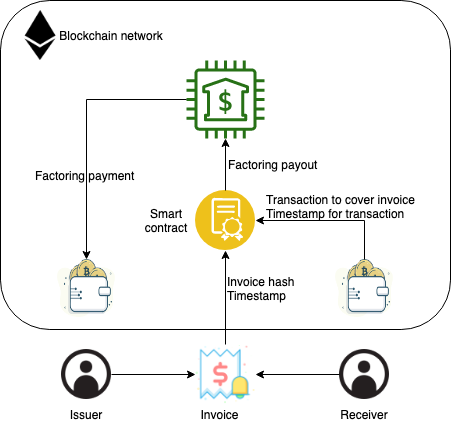

High-level Flow Overview:

Using blockchain in factoring agreements would:

Those features are usually associated with optimization rather than with innovation. But Turing-complete blockchains such as Ethereum also have the ability to create non-fungible digital assets that hide innovation potential from the market of factoring services. With this ability, each invoice could be created as a digital asset with its value . When invoices are split into separate portions with different values, they can then be sold to different factoring companies or covered with factoring partially, while the relation of each non-fungible asset could be tracked up to original hashed invoice in a tree-structured manner.

Blockchain Factoring with Non-Fungible Assets:

Blockchain is already in the early stages of being adopted into the value chains of production companies, though it is currently mostly used in supply chains. There is huge potential in blockchain’s ability to improve financing through commercial credits.

Commercial credit is a loan in which funds are not actually transferred between the involved parties. It is much cheaper than a bank loan or credit line but in general parties of the commercial deal have limited financial resources to provide it. Another issue is that large manufacturers aiming to employ Just-In-Time production in their value chain depend on smaller enterprises that may suffer from limited financial capacity and therefore could not achieve JIT production.

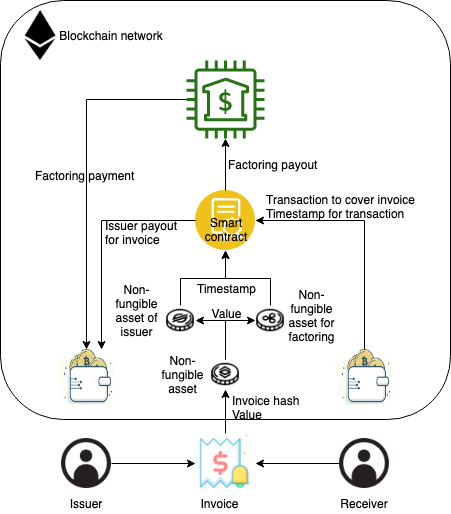

Solutions empowered by blockchain are typically employed in industrial-scale enterprises, but could be considered for large and, in rare cases, medium-sized enterprises as well. Using this strategy, a private (consortium) blockchain network is created in which the key recipient of the value chain uses a smart contract on goods and services delivery with its supplier as a commitment for eventual payment for goods. Those suppliers then create a “child” smart contract with their suppliers, where funds are transferred from the “parent” smart contract.

All contracts have a multisignature feature; transferring tokens requires the signatures of both the contract creator and receiver, or the owner of the “child” smart contract. This process creates transparency within the distributed value chain and allows end-good produce, which commonly have higher financial capacity. Signing parent smart contracts to provide financial for any supplier within this sequence grants a commercial credit and ensures JIT delivery and production are independent from their suppliers’ financial capacity.

While end-good producer benefits from JIT production, other parties in the value chain benefit from reduction of cash conversion cycle and working capital unfreeze as this approach is lovering time of account receivables/payables and inventories.

Financial derivatives are one of the most complex tools in company financing. While first derivatives are more or less clear, for many, collateralized tools can seem as inscrutable as rocket science. The most widely used collateralized derivatives are Collateralized Debt Obligations (CDO), which are created from mortgage agreements. Because real estate is one of the most stable markets when it comes to returns on investment, it is not circulating within financial institutions like CDOs on mortgage for this estate. CDOs are usually comprised of several mortgages of different risk rates, which reduces the chance of “junk” mortgages.

When CDOs were initially created they were not considered to be complex, because relative to their peer mortgages, CDOs only have a 5-10 year lifespan. But when the first buyout for mortgages began, it became clear that real estate owners could not obtain full ownership rights from mortgage if it already was included in CDO that is not buyout in full. And, as a result, there was no way to determine who ultimately become the owner of the CDO.

The use of blockchain could improve this field through a combination of non-fungible tokens and smart contracts, as follows:

This approach requires a high amount of transactions that makes it too costly for public blockchain, but in permissioned versions it is more than possible. An additional benefit of this use of blockchain is that it enables owners to control derivative turnover while maintaining privacy, because neither the account address, nor the token, nor the smart contract includes personal or private data, instead relying on hashes to ensure the immutability of the agreement.