How the Consortium Blockchain Works

September 25, 2019

Corda and Real Businesses Built on Top of This Framework

August 23, 2019

While we accept the fact that blockchain and cryptocurrencies are the technology of the near future, we are not there yet. Speculation and over inflated expectations ignore the real value of the technology. There is an extremely wide range of potential token uses but only a handful of successful projects.

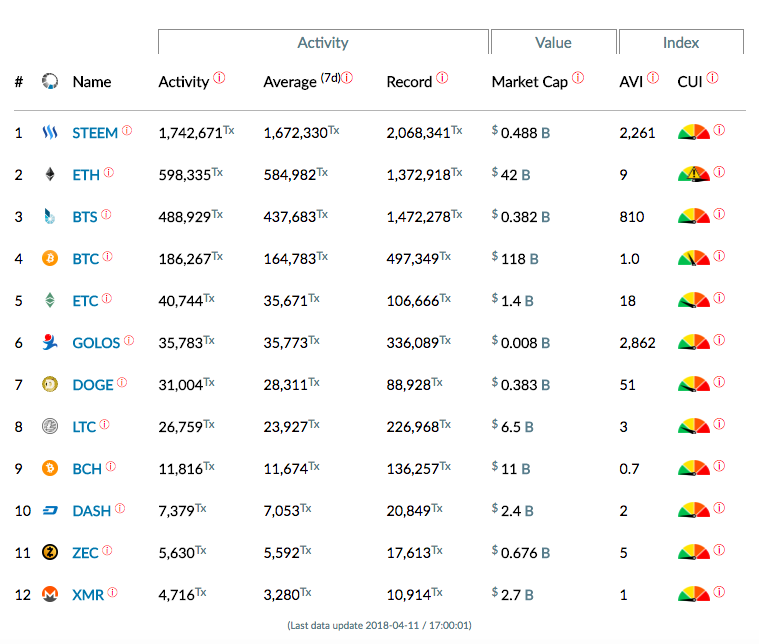

To help navigate a business owner or investor through this novel industry, we decided to take a look at the most popular cryptocurrencies. The following overview is highly objective, as it only considers network, (namely the number of transactions), using a resource called Blocktivity.

Blocktivity snapshot as of April 11th, 2018

What can we derive from this information? Although it is hard to predict a future trend in blockchain technology, we can clearly see what projects are the most popular in terms of transactions.

Steem is an incentivized blockchain-based public content platform. Users create and curate content on Steemit just like on Reddit, Hacker News, or other social media platforms, and get rewarded in STEEM tokens for their work.

Notably, there are three native tokens that perform different functions. STEEM is the unit of account, which can be locked in contracts in addition to being traded. STEEM tokens can be turned into Steem Power (SP), giving one the right to capture a share of network rewards, and carry more weight when curating activities while contributing to the protocol. The third one is a stable currency pegged to a fixed dollar price — Steem Dollar or SBD.

Ethereum, the new generation blockchain, is proven here to be successfully serving its mission to support DApps, ICOs, and DAOs (see blockchain glossary). Since its launch in 2015, it has helped to grow a vast number of blockchain projects, thanks to its innovation of smart contracts. Today, there are other platforms competing with Ethereum: WAVES, NEO, DFinity, and Cardano to name a few. However, Ethereum will only get stronger. Here’s why.

BitShares is a blockchain-based, real-time financial platform. It provides a decentralized asset exchange — similar to NYSE but for cryptocurrencies — without the need to trust a central authority to handle all the funds. BitShares has its own token called BTS which can be transferred between accounts and are used to collect fees for network operations as well as being a collateral for loans. BitShares pioneered the Delegated Proof-of-Stake consensus protocol.

Taking into account Bitcoin’s pure currency nature, its fourth place entry in the activity ranking proves its popularity and usefulness. For instance, blockchains in Steem and Ethereum are responsible for each small change in the application running on them. In Bitcoin, all of the transactions are financial. Needless to say, Bitcoin is here to stay.

Golos is yet another media platform on blockchain like Steem. It confirms the idea that such blockchains are much more active in terms of transactions, despite being less valuable in market capitalization.

One obvious prediction for future blockchain activity is the domination of social networks and new media types. On the other hand, this is likely to be a red herring for two reasons. First, we’re likely to witness new, even more complex computational blockchains. Secondly, there is usually no need to perform blockchain operations online; rather, it is more convenient to utilize off-chain solutions like the Lightning Network or parallel blockchains like Cosmos Network. As a result, most of the activity of social networks could happen on parallel chains.

In conclusion, it is worth noting that in addition to price movements and changes in market capitalization there are other ways to calculate the productivity of blockchain projects, like the amount of transactions per day. Data from the Blocktivity website indicates both the maximum capacity and the activity of blockchains. Although this might be a useful metric, one must remember that each blockchain serves its purpose and the transaction speed usually comes with a trade off of either security or decentralization.