How the Consortium Blockchain Works

September 25, 2019

Corda and Real Businesses Built on Top of This Framework

August 23, 2019

When we looked at hospitality use cases, we touched upon insurance as one of the industries that could benefit from blockchain. Today we are going to explore Insurance Technology powered with distributed ledgers, in depth.

To start with, it is hyper complex. When customers are presented with a lengthy contract, they may find themselves in a state of analysis-paralysis and become frustrated by the process. From the insurer side, a firm must consider a fair number of uncertainties and verify that a customer did not falsify the evidence that triggered the contract conditions.

“90% of insurance companies are concerned about competition from insurtechs”

— from the PwC report

“Opportunities await: How InsurTech is reshaping insurance”

Besides, the insurance industry is constantly accused of being slow to adopt digital technologies which is why the insurtech companies started entering the market in the first place. The term “insurtech” describes an innovative venture targeted at extracting savings and efficiency from the current insurance industry model. Insurtech is inspired by the term “fintech” and consists of the words “insurance” and “technology”. Today, people are generally referring to artificial intelligence (AI) and blockchain when they discuss insurtech. The latter has the biggest potential to benefit this industry, in large part due to the decentralized, immutable, and transparent nature of a ledger distributed among participants.

Insurtech Startups. Credits: PwC

Although the PwC report “Chain Reaction: How Blockchain Technology Might Transform Wholesale Insurance” highlighted that 56% of insurance companies recognize the impact of blockchain, 57% of them still do not know how to effectively respond to this opportunity and capitalise on it.

Blockchain is a type of a Distributed Ledger Technology (DLT) and relies on asymmetrical cryptography to allow the use of a paired public and private key system and a distributed IT architecture to leverage P2P interactions. These characteristics lift the curtain on new possibilities, especially taking into account that 59% of insurance companies confirm that the primary objective of their investment is to transform the business and its current operating models (KPMG, 2017).

Smart contracts allow us to rethink at least two key domains of the insurance industry. First of all, they enable extensive automation and autonomy of management processes. This would be based on the data reported by a network of IoT devices which would inform smart contracts when the necessary conditions had been fulfilled. Secondly, the infinite and immutable data history rooted in a ledger keeps all the records, including the data provided by the IoT.

InsurETH, a Dapp based on an Ethereum smart contract, launched in 2015 as the result of a hackathon and has chosen a narrow specialization for this market. Project JUR.io emerged specifically to make dispute resolution fast and easy at a fraction of the cost, also leveraging smart contracts.

This leads to notable improvements within the sector such as peer-to-peer or P2P insurance.

According to the the PwC report “Blockchain, a catalyst for new approaches in insurance,” if the smart contract communicates with other contracts, it can simultaneously contribute to an “open network enterprise” (ONE). Combining ONEs with the notion of a DAO allows the creation of an organisation that both generates and captures value without a traditional management structure. For instance, the French start-up Wekeep contains pool insurance premiums for non-mandatory insurance stored in a smart contract and signed by various parties.

“We need to be wary of the term ‘legal vacuum’… Blockchain exists within a legal framework. In fact, the consensus protocols established to organise blockchain governance already constitute an agreement between parties. The real difficulties lie in the need to (1) establish new classifications and apply an appropriate legal framework to the technology in order not to limit its possible applications, and (2) take into account the international dimension”

— Sandrine Cullaffroz-Jover,

Lawyer and Director at PwC Société d’Avocats,

an excerpt from the PwC report

Index-based insurance links an underlying index, be it a rainfall, temperature, humidity or crop yield, to the quote. When transferring such insurance on smart contracts, the products become automated, simpler and cheaper. Theoretically, a smart contract between a farmer and an insurer could trigger a payment if there is no rainfall for 30 days. Feeding the contract with reliable external data helps to avoid false claims from the insured party as well as removing the need for an expert on-site assessment.

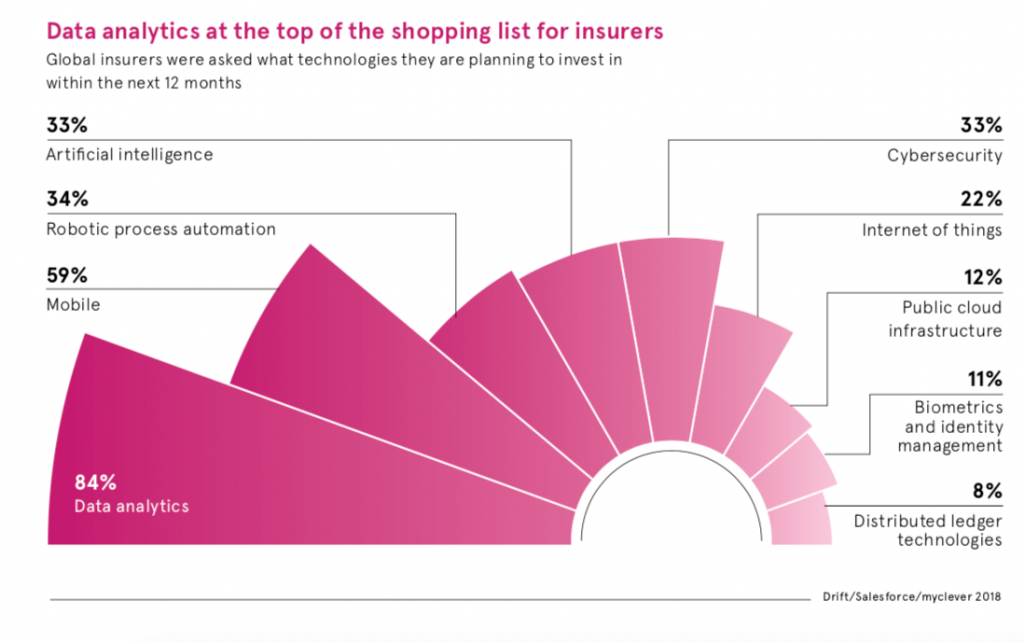

The Future of Insurance: industry trends for 2018. Credits: Raconteur

Blockchain can act as a self-executing trusted third party, helping to decrease the overhead costs while expediting management processes and securing them. However, the cost of setting up such an arrangement for industry agreements could become an obstacle as each party would require to connect its IT processes to such a system.

Reinsurance allows transferring the risk from an individual entity to a captive reinsurer, represented either by a separate entity or a department within the holding company. As a result, the insurance group can attain capital efficiency since diversification is intense at the level of the captive. Blockchain could resolve the difficulty of internal reinsurance mechanisms which often entail swift and complex information exchange due to regulatory or fiscal requirements.

Blockchain is part of the insurtech solution puzzle. While removing intermediaries in a new type of arrangement, blockchain technology could completely invert the insurance value chain: from development and acceleration of novel products and markets through to new approaches for operation of insurance agreements.

Therefore, to sum up the major improvements DLT can bring to the insurance industry:

Will Pritchett, head of technology, insurance and investment management at KPMG, believes that insurance organizations aim to transform themselves by becoming fully digital and putting customers back in control. By removing much of the physical data, the most progressive companies are moving legacy mainframes to the cloud. DLT is going to make this process reliable and secure as well as ensure lower costs of maintenance. What is more, blockchain’s value proposition offers management in a completely automated manner which allows insurers to offer better-priced and more flexible packages.

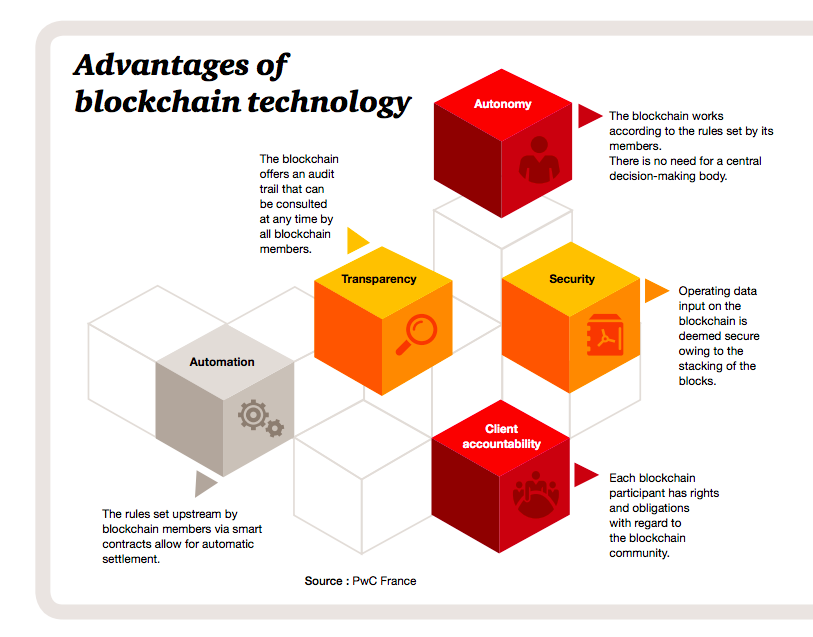

The basic components of blockchain technology. Credits: PwC

Karim Derrick, who is a head of research and development at global lawyers Kennedys, speculates that most of the activity around blockchain amounts to “hot air”. Nevertheless, his company has developed a fraud-focused insurance prototype on Hyperledger. Another case is Everledger that evolved from the start-up accelerator program sponsored by insurer Allianz France. The team behind it has designed a certification system for luxury products that utilizes a mix of private and public blockchain technology.

“Most fraud happens because clients have their own databases and there is very little interaction that is automated, so fraudsters operate in the gaps between these databases,” Derrick says. “Blockchain will enable insurers to share their books with each other without exposing their books.”

The current data centralisation model puts organisations at risk. The number of cyber-attacks is on the rise and the millions of stolen personal data points of customers this results in is alarming. In 2013, hackers illegally acquired 1 billion accounts from Yahoo, a year later they hacked 500 million more. In 2014, eBay leaked 145 million accounts while JPMorgan could not protect 76 million accounts of retail customers and 7 million of institutional customers. Since in blockchain data is not stored on a central database, similar attacks are close to impossible.

Therefore, enabling cross-reference claims will make it difficult for fraudsters to exploit ignorance between partners in a consortium private blockchain. According to Goldman Sachs, a consistent and coordinated use of DLT in banking could save the industry between $3 and $5 billion a year in KYC and AML costs. Projects like InterchainZ are already on the path to delivering a database solution to this end.

Eventually, blockchain technology can help insurers reach new markets and launch various products there due to the low incremental costs associated with smart contracts. The simplicity and immutability of blockchain as well as the determinative nature of smart contracts will inevitably give birth to innovative solutions and service bundles. It is happening now already but most of these pilots are in stealth mode.

Is blockchain the solution for you?

Instead of a firm conclusion one way or the other, we offer you a checklist that intends to aid in the shaping of your insurance business. If you answer ‘yes’ to at least four of these questions, blockchain could be the solution for the service you offer.

- Are multiple parties sharing data?

- Will multiple parties be updating data?

- Is there a requirement for verification?

- Is verification adding cost and complexity?

- Are interactions time sensitive?

- Will transactions by different users depend on each other?