How the Consortium Blockchain Works

September 25, 2019

Corda and Real Businesses Built on Top of This Framework

August 23, 2019

In 2017, the media “buried” Bitcoin over 100 times, and regulators were jumping on its tail with regulation, taxes, and simple bans. Nevertheless, we also saw some significant adoption: Japan allowed the number one cryptocurrency as legal tender, citizens of Zimbabwe protected their assets by converting them into BTC, and Venezuelans joined the ranks of the global mining leaders thanks to their ridiculously cheap electricity.

Rather than forbidding cryptocurrencies completely, some countries are developing their own alternatives. Sweden is already on its way to e-krona. China is cautiously testing its own digital currency, and both Poland and Estonia are looking into the business with dPLN and estcoin respectively.

But here’s the catch. There’s a significant difference between digital cash and cryptocurrency. The former remains traditional cash — fiat — backed by the central bank but in an electronic medium. For the currency to attain “crypto” status, it needs to meet a few more criteria:

It means that a currency is not only encrypted for security reasons but is programmed to be immutable. It can’t be changed. As there is no central authority to manage the funds, there’s no-one in a position to make changes to the database of the digital currency. In fact, this is the next characteristic of a true cryptocurrency.

Nobody controls a cryptocurrency. Where a digital currency has one or more centralized servers, cryptocurrency relies instead on a geographically widespread network of “nodes” that keep the entire history of transactions. Thus, decentralization itself immunizes cryptocurrencies from the potential for double-spending or hacker attacks.

The word “controlled” here refers to a programmable way to create new tokens in systems where there is no limit. Tokens cannot be added at will, unlike a government or central bank controlled system where new banknotes can be printed whenever it’s deemed necessary. Inflation is not necessarily a bad thing, but some countries do not use this mechanism wisely.

This one is tricky. We usually think that all our information is confidential when using digital money. However, this privacy is misleading since governments and banks can peek into our deposits and see the entire history of asset movement. With cryptocurrencies it’s different: while anyone can see the transaction history among accounts and the number of tokens, the identity behind them is unknown. This makes both transparency and anonymity the hallmarks of true cryptocurrency.

With cryptocurrency, anyone is free to join. There is no need for ID confirmation or a bank account.

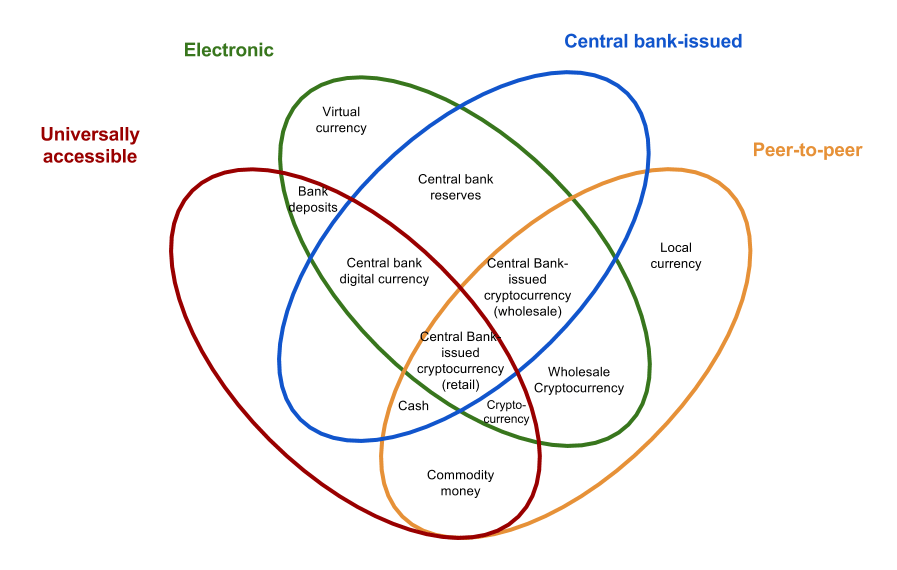

Taxonomy of money, based on “Central bank cryptocurrencies”

by Morten Linnemann Bech and Rodney Garratt.

The Russian Federation also surprised many with talk about launching a national cryptoruble. Later on however, their tone suggested that they saw a need not so much for a national cryptocurrency as for a multinational one. In fact, Russia has long been seeking a multinational currency that could tackle the euro and dollar and shift the balance of global economic power. Ultimately, their proposals largely address the regulation of cryptocurrencies, not their development.

So despite the loud headlines, it doesn’t look there is a true cryptocurrency being developed by a central authority, and that seems unlikely to change. Instead, countries are looking into the creation of digital cash to reduce the number of banknotes and the cost for financial operations.

One upside to all this attention to distributed ledger technology though, is that it increases blockchain adoption significantly. As a result, we’re witnessing new open-source solutions and continued investment in the industry, which in turn leads to better infrastructure and greater transparency.