How the Consortium Blockchain Works

September 25, 2019

Corda and Real Businesses Built on Top of This Framework

August 23, 2019

The Initial Coin Offerings (ICOs) were trending in the crypto industry between 2017 and 2018. Security Token Offerings (STO) came after as a logical sequel. At the same time, the Initial Exchange Offering (IEO) is becoming a new approach towards raising capital in a secure, efficient, and effective manner. The IEOs are able to provide an additional layer of security that ICOs were lacking in the past. In addition, the IEOs are offering extra features that increase their attractiveness to investors and companies seeking funding.

The Initial Exchange Offering is a sale of tokens via an exchange which acts as an intermediary.

The general process of an IEO requires several steps:

The conditions of the agreement between the development team and a project team include several details, namely the fixed price per token and the limit on the contribution per individual. The contributor must set an account with an exchange to participate in an IEO, including transfer of cryptocurrency and the potential purchase of the exchange tokens. The purchase of tokens occurs during an IEO directly from the exchange.

IEOs and ICOs differ based on their specific characteristics related to market accessibility, liquidity of the tokens, and underlying security:

The participation in an IEO requires having an account with the specific exchange. Next, it is necessary to pass the Know Your Customer (KYC) screening process. In addition, it is essential for the participants to qualify based on geographic location, since some countries, such as the United States, Venezuela, China, North Korea, and New Zealand, are unable to participate. It is vital to determine in advance the list of cryptocurrencies accepted during an IEO to send them to an account. Some exchanges have their own tokens, requiring advance purchases.

The IEOs have several essential benefits that contribute to their attractiveness. The primary benefit includes immediate access to the user base of the crypto exchange. Such approach ensures participation for the large number of people, as well as the higher funding potential for the project. The second benefit relates to the lower levels of risks associated with scams. The resulting level of security favors the contributors. The third advantage stems from the reliability and credibility of the process, effectively offering reputational enhancement for the project. The diligence work conducted prior to the IEO launch minimizes the risks of failure and lack of delivery over time. The third benefit stems from the following listing potential on an exchange.

The exchange providing platforms for the IEOs operate on similar business models. Trading fees are the primary source of revenue streams generated by these entities. The exchanges have to remain competitive for attracting the larger trader base. Such an approach will ensure the sufficient trading volume and funding offered during the IEOs. In addition, the exchanges facilitating IEOs receive fees, which may vary depending on an exchange. Loyal traders operating on the long-term basis ensure sustainability of the business models by allowing projections of the revenue streams. The exchanges might also gain from marketing activities conducted with the companies undergoing IEOs. The marketing efforts support the launch of an IEO by increasing its visibility for the different groups of traders.

The IEO market took off primarily at the beginning of 2019. Its launch was the result of the successful growth of Binance in 2018, reaching the spot of the largest cryptocurrency exchange on a global scale with the profits reaching $446 million. Binance has made an announcement that it will be holding token sales on its Binance Launchpad platform on a monthly basis in 2019. BitTorrent was the first company launching IEO on Binance Launchpad with the market capitalization of $7.2 million reached immediately following the launch.

The second company was Fetch.AI with the market capitalization of $6 million reached immediately following the launch as well. The third, and the most recent campaign, was Celer Network reaching hard cap of $4 million during the first 17 minutes after the start of an IEO. The only main problem of Binance related to technical difficulties associated with handling the levels of demand based on the number of users. In particular, approximately 35,000 traders were unable to purchase CELR tokens prior to the achievement of hard cap.

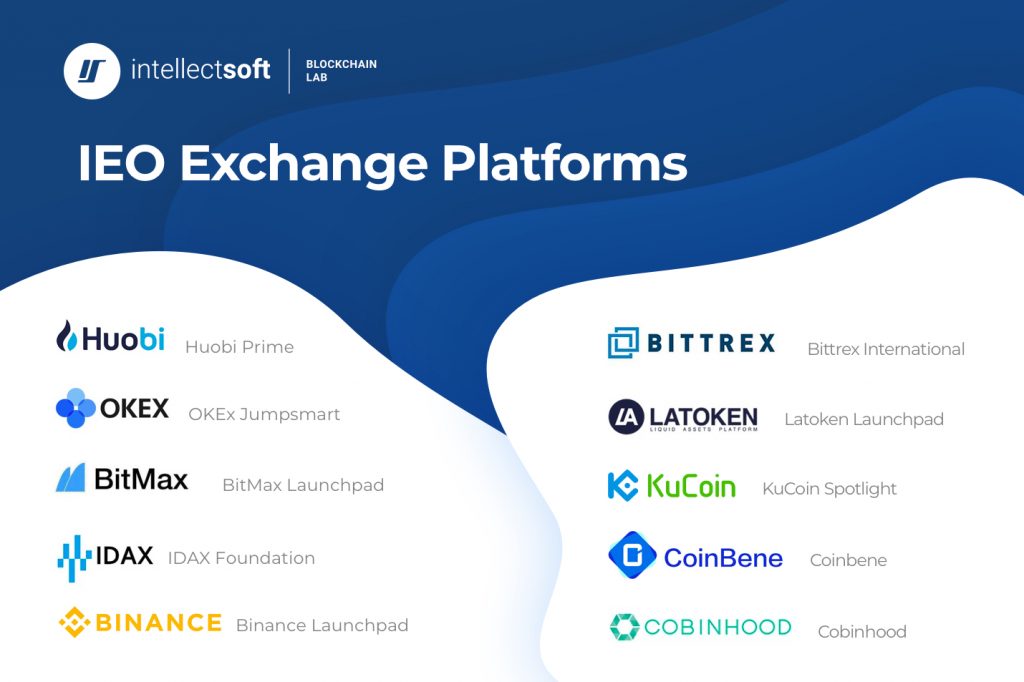

The success of Binance and Binance Launchpad has inspired other exchanges, including Bittrex, Bitmax, Huobi, KuCoin, and OKEx.

The popularity of IEOs has resulted in stricter qualifying conditions for the projects and companies. In particular, they have to present a strong business model, working product, potentially undergoing development, the necessary documentation, token growth justification (economics), strong existing community, reputable team and advisors, strong social media and public relations, as well as utility tokens. Lack of these vital components may result in underperformance of the project and the subsequent reputational damages for the exchange. Therefore, the exchange has an interest in quality companies conducting IEOs on their platforms.

The exchanges are continuing development of their IEO launch platforms, while various projects have completed their IEOs recently or expecting completion in the near future. In particular, Matic has a scheduled IEO launch on April 24, 2019 with the hard cap of $5 million. VeriBlock has completed its IEO on April 2, 2019 on Bittrex International IEO reaching hard cap of $7 million. TOP Network has completed its IEO on Huobi Prime raising $15 million on March 26, 2019.

IEOs have become an alternative to ICOs because of the higher degree of reliability, transparency, and security. Contributors and investors win from the new approach because of its simultaneous simplicity and trustworthiness. The companies and projects involved in IEOs face stricter regulatory requirements, while improving their business models to match the new standards. The future of the IEOs will depend on the success of the companies and projects, as well as the access of the major countries, such as the U.S. and China, which will provide an additional influx of capital, boosting liquidity of the markets.